Author: Christopher L Aversano, Q88 Position List & Q88PRO Product Manager

I learned a long time ago to “expect the unexpected.” While that isn’t necessarily a term unique to the shipping industry, it certainly applies in recent years. Think back to the start of the global COVD-19 pandemic more than two years ago when global trade and supply chains were severely disrupted, and tens of thousands of ships sat idle for longer than ever before.

Back then, at that moment in time, I don’t think anyone could have predicted that just in a couple of years’ time, the orderbook for newbuild ships would be so big that there would very few slots available for tankers in the next few years. In fact, during an investor presentation by TK Tankers in mid-May this year, the ship owner confirmed that ‘shipyards are largely full through 2024 and an estimated 60% full through 2025.’ Unbelievable!

For anyone even mildly interested in the comings and goings of the global shipbuilding market, it’s been hard not to take notice of broadcasting of newbuild contracts by the maritime press. You can’t scroll through any of the major maritime publications without seeing another massive order being placed for containerships. In April, Splash 24/7, with attribution to Clarksons, reported that Mediterranean Shipping Co (MSC) had ordered 14 container ships. On June 6th, Lloyd’s List reported that in the week previous $4.5bn worth of containerships had been ordered, spanning 30 ships between 2,800 teu and 23,000 teu capacities.

On top of media reports, comparisons are being drawn to previous years that highlight the size of the containership building boom. Data analysts, Vessels Values confirmed in one of their analyst reports that 561 container vessels were ordered in 2021 compared to 114 in 2020. The surge in containership orders can be attributed to cash-rich owners rapidly expanding their fleets off the back of high rates and high demand.

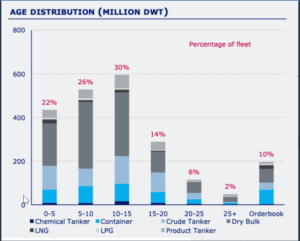

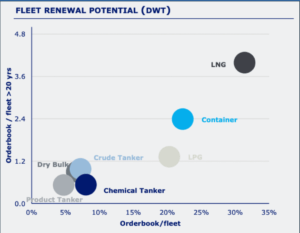

A boom is also occurring in gas tanker buildings – LNG and LPG tankers in particular. This is good news for the shipyards since they tend to focus on this class of ships as they generate more revenue. In their latest report, the Danish Ship Finance group confirms the clear preference for the gas and container fleet and the lack of newbuildings for the tanker (crude, product, and chemical) and dry fleets – see the first graph below. The second graph shows how the global fleet ages out, which is even more striking.

Insights into the shipbuilding market such as this are made possible by the analysis of relevant data. But how do you access such data, and how much time is required to trawl through statistics on shipbuilding contracts or vessel data? When it comes to needing deeper insights into global new building activities and trends, such insights are less readily available or easy to understand from publicly available data or maritime media reporting.

Take the Danish Ship Finance graphs as an example. How do those data points get turned into valuable information that can be used quickly and effectively for commercial decisions? Having access to market trends and how they relate to tonnage supply and commercial decisions is an incredibly powerful asset, but where do you find the time to gather and interpret the data required? Luckily for users of Q88.com, Q88PRO, and Q88 Position List platforms, they can unlock the ships behind the data and dig deeper into trends. These advanced platforms can provide up-to-date, fast information to commercial and operational teams, allowing them to keep their finger on the shipbuilding and repair pulse to make better decisions or have a clear view of the market.

From Q88.com, shipowners, brokers, charterers, operators, or any person conducting business within the maritime industry can access information that is backed by over 250 data points per vessel. This gives users an unprecedented view of the marketplace from a single, central access point. On top of that, upgrading to Q88Pro improves the flow of information through your organization while empowering their commercial team to see a broader (and deeper) view of the market. AIS position data and searchable position lists also enable ship owners and charterers to track their fleets and global tonnage supply and competitive market insights of the industry at large.

But that’s not all; the Q88Pro and Position List platform have an advanced search feature that allows the user to look at the year built to show exactly what ships start to hit the 20-year mark and rank them by size. Tracking when ships are due for their next special surveys, the yard of build, and other criteria is also possible.

Our subscribers can sort data in columns by age, deadweight, and next dry dock, just to name a few. Combining those search parameters with our AIS data from the Position List tool unlocks a more powerful way to look at where the ships are and where they are going. This all leads to gaining a better understanding of supply trends, thus making it easier to decide about taking in a ship, letting one out, or perhaps looking at a new building.

For our customers, unlocking the ships behind the data means keeping a finger firmly on the pulse of the global fleet. In a fast-moving market, having data-driven, in-depth insights on ships at the push of a button supports commercial decision-making like never before.

Rebecca Galanopoulos Jones

Rebecca Galanopoulos Jones

Ayodele Fashakin

Ayodele Fashakin